what is schedule h on tax return

A Schedule H breaks down household employee payment and tax information. It is filed annually with the Form 1040.

Irs Releases Form 1040 For 2020 Spoiler Alert Still Not A Postcard

Schedule H Form 1040 for figuring your household employment taxes.

. What is Schedule H. Click Other Tax Situations along the top. The Schedule H is used for reporting wages you pay household employees and figuring out how much tax you must pay as the employer.

Scroll down to Nanny and household employee tax. The IRS requires you to report household employment taxes on Schedule H with your personal tax return. Have an EIN File forms W2 and W3 by the W2W3 due date typically January 31 File Schedule H and p ay household employment taxes with their 20YY tax return.

When you paid cash wages to a household employee and those wages were subject to Medicare Social Security andor unemployment taxes or you withheld federal income tax you might need to file Schedule H. TurboTax has two copies of Schedule H because on a joint tax return it makes a difference who the EIN was issued to. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Household employees must record their wages earned from household employers. This includes facilities operated either directly or through disregarded entities or joint ventures. Form W-3 for sending Copy A of Forms W-2 to the Social Security Adminis-tration SSA.

A tax schedule is a form the IRS requires you to prepare in addition to your tax return when you have certain types of income or deductions. I believe there were some last minute changes made by the IRS in regards to Covid related leave. The Congress incorporated household employment taxes into the Federal income tax return in 1995 and as a result submitting a personal tax return without including the household.

To distinguish the two copies TurboTax calls them Schedule H-T for the taxpayer and Schedule H-S for the spouse. 2021 Instructions for Schedule HHousehold Employment Taxes Here is a list of forms that household employers need to complete. Screen H is available for completion on the Taxes tab in an individual return.

The amount you owe in nanny taxes as these taxes are often referred to will be calculated in two parts. Schedule H is used by household employers to report household employment taxes. Schedule H is where you report household employment taxes to the IRS and is filed with your personal tax return.

Ad Download Or Email Form B6H More Fillable Forms Register and Subscribe Now. How do I file a Schedule H. Form W-2 for reporting wages paid to your employees.

Schedule H is the form the IRS requires you to use to report your federal household employment tax liability for the year. Schedule H Household Employment Taxes latest version is a form that household employers use to report household employment taxes to the IRS. These commonly include things like significant amounts of interest income mortgage interest or charitable contributions.

Schedule H often referred to as the nanny tax is a form you file with your taxes if you have household employees that you paid more than 2300 in the year or 1000 in a quarter. If you paid cash wages to a household employee and the wages were subject to Social Security Medicare andor FUTA taxes or if you withheld federal income tax then you likely need to file Schedule H. You must file a Schedule H if.

The Form 1040 Schedule H is the document that computes the amount of household employment taxes you owe and will add this tax due to your personal income tax return. When you file Schedule H with your return you will pay both the employment and income taxes to the United States Treasury. According to the most current IRS statistics approximately 190000 household employers nationwide file this mandatory form each year.

Form W-3 for sending Copy A of Forms W-2 to the Social Security Adminis-tration SSA. If you are filing jointly TurboTax asks who is the. Use Schedule H Form 1040 to report household employment taxes if you paid cash wages to a household employee and the wages were subject to social security Medicare or FUTA taxes or if you withheld federal income tax.

If you are not filing jointly TurboTax uses Schedule H-T. If the taxpayer is a household employer they must. Scroll down to the Additional Tax Payments section.

Paid any one household employee cash wages of 1800 or more during the calendar year withheld federal income tax during the calendar year for any household employee or. If you are not filing a current year tax return you must file Schedule H by itself and mail it to the IRS. Hospital organizations use Schedule H Form 990 to provide information on the activities and policies of and community benefit provided by its hospital facilities and other non-hospital health care facilities that it operated during the tax year.

Schedule H Form 1040 for figuring your household employment taxes. Part I is where you figure and report the Medicare and Social Security Tax you owe for your employees. Schedule H is still under construction and will be ready 3172022.

2020 Instructions for Schedule HHousehold Employment Taxes Here is a list of forms that household employers need to complete. From within your TaxAct return Online or Desktop click on the Federal tab. Schedule H Household Employment Taxes is where you report household employment taxes to the IRS.

If you paid cash wages to a household employee and the wages were subject to Social Security Medicare andor unemployment taxes or if you withheld federal income tax then you likely need to file Schedule H. To enter the data for Schedule H for Household Employment Taxes into TaxAct. Click Taxes to expand the category and then click Taxes for Household Employees.

Add Schedule H to your tax return. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. What is Schedule H.

On smaller devices click the menu icon in the upper left-hand corner then select Federal. Generally the totals you compute on these schedules are transferred to your Form 1040. Schedule H is used to enter information about taxes withheld for household employees.

Ad Download Or Email Form B6H More Fillable Forms Register and Subscribe Now. Form W-2 for reporting wages paid to your employees.

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

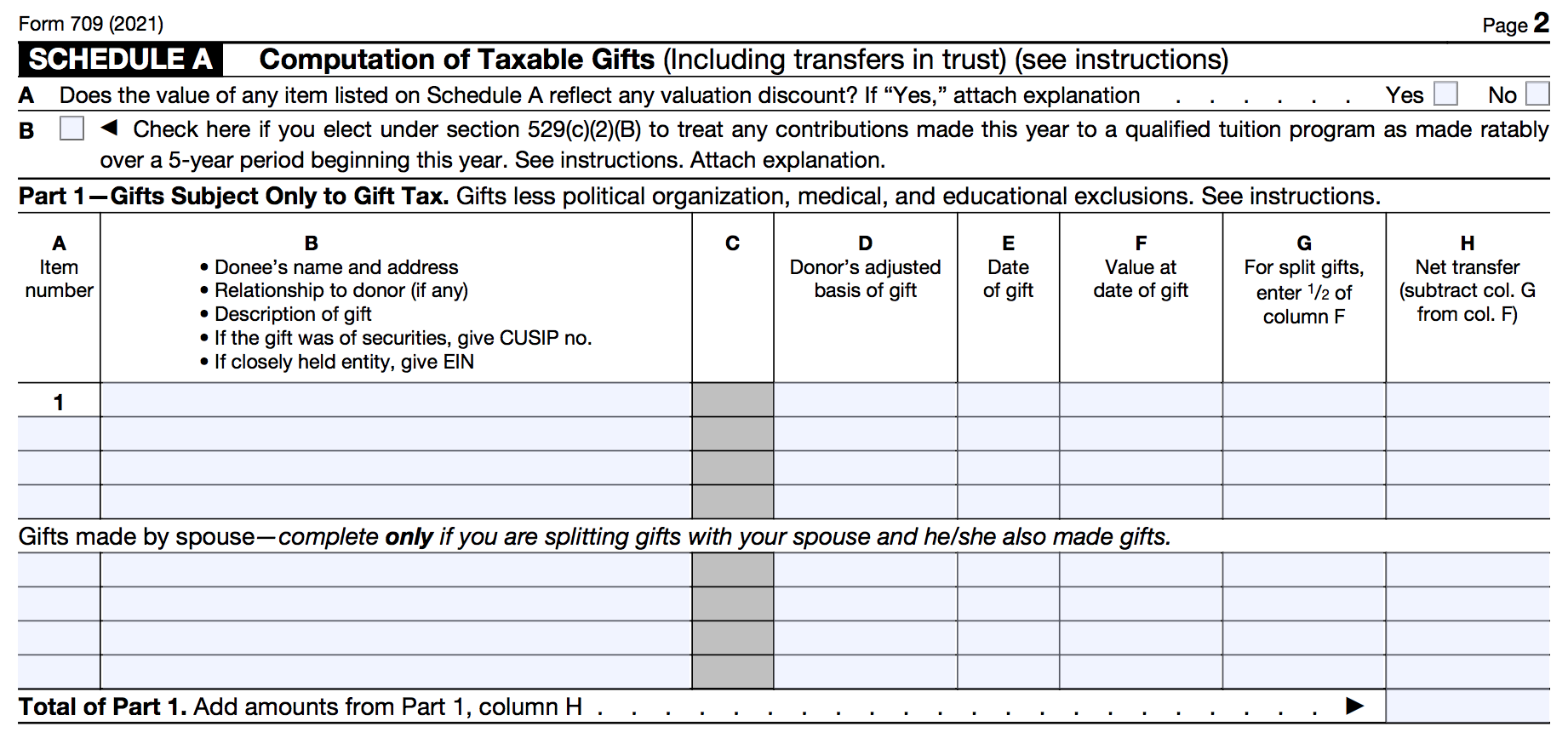

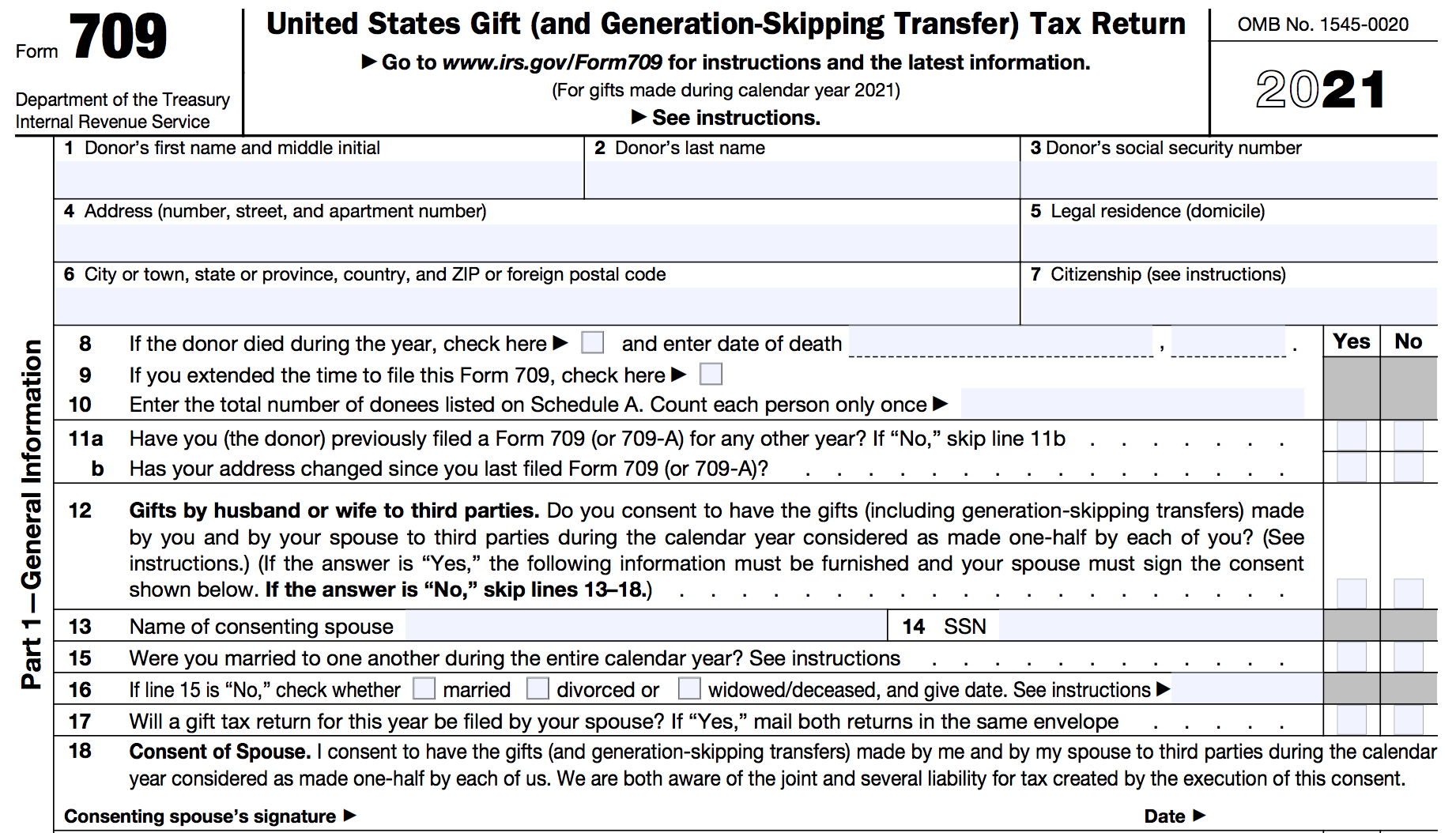

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

:max_bytes(150000):strip_icc()/schedB-7250cc494af24b9fa7dd368806aafcc5.jpg)

Schedule B Interest And Ordinary Dividends Definition

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

What Is Schedule C Tax Form Form 1040

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

How To Fill Out Your 2021 Schedule C With Example

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)